More than 1600 institutions representing over $40 trillion have committed to move their investment dollars out of fossil fuels and toward a clean energy future. A growing number of Jewish institutions are joining them. Will your institution be next?

In spring of 2024, Oregon’s two Jewish Federations made history by becoming the first Federations to commit to screen fossil fuels out of their investments. A month later, the Union for Reform Judaism became the first and largest denomination – representing more than a third of American Jews – to move its own money out of fossil fuels and to pass a resolution recommending its institutions do the same, and engage in shareholder advocacy with other polluting industries.

By moving money from fossil fuels to clean energy, Jewish institutions not only align their investments with their values, they also fund much-needed climate solutions. Plus, they demonstrate to the world’s largest banks and asset managers that their customers and clients expect them to stop funding fossil fuel expansion and instead fund more clean energy. The collective impact can shift capital at scale to realize the clean energy needed for a livable world for generations to come.

Latest Updates

A ROADMAP FOR CHANGE

Together, we can educate, engage, and mobilize the Jewish community to take climate action; move billions in Jewish communal assets away from fossil fuels toward clean energy; and leverage our institutions’ power as clients and customers to urge the largest asset managers and banks to stop financing coal, oil, and gas expansion and instead fund a clean energy future.

Dayenu offers a roadmap for moving institutional investments from fossil fuels to clean energy. The six-step process is designed to transform our institutions and raise a powerful voice for climate action. Each step is key to maximizing our collective impact.

Resources

Designed especially for lay leaders at Jewish institutions, this unbranded resource outlines how screening out fossil fuels from an organization’s endowment can be a strong fulfillment of fiduciary duty.

This resource on fossil-fuel free investing for Reform institutions is a helpful guide for adopting the URJ’s fossil-fuel-free investing recommendation. Dayenu is here for additional support.

Access a pdf version of the All Our Might Frequently Asked Question (FAQs).

Start your journey along Dayenu’s roadmap with Reishit Chochma (beginning with wisdom), and learn from Jewish sources that invite us to bring “all our might” to combatting the climate crisis.

Like every field, finance has its own jargon. But that need not stop you from taking meaningful action on climate change. Use this resource to demystify common climate finance terms.

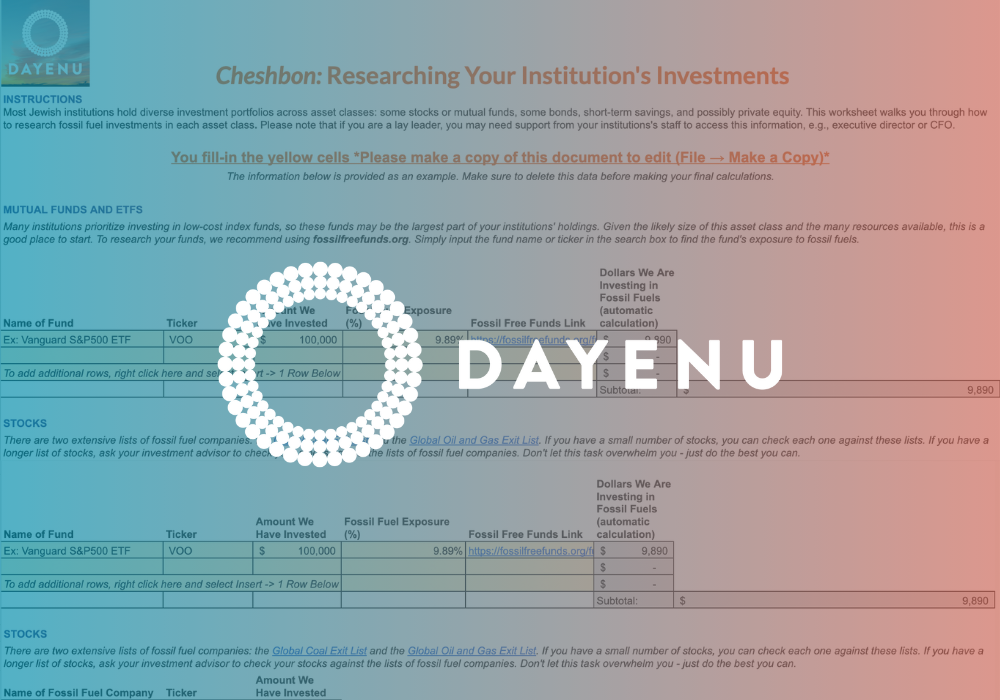

You may not yet know what funds your organization is invested in or their potential exposure to fossil fuels. Use this simple worksheet to make an accounting (Chesbon) of “what you own.”

If you do not hold a formal role with your Jewish institution, you can still make a difference. Use this resource to prepare to meet with leadership and collaboratively move the institution along the roadmap.

Use this step-by-step guide to run a conversation engaging your community in learning (Limmud) and increase buy-in to move its money out of fossil fuels and invest in a clean energy future.

Listen to this playlist to help inspire you as you take action. We can move from fear to courageous action.

CASE STUDIES

1. BRANDEIS UNIVERSITY

Brandeis University is animated by Jewish values, rooted in Jewish history and experience, and has a long tradition of student activism. The University’s journey to fossil-free investments reflects the intersection of these rich threads. Read More →

2. NYC PENSIONS FUNDS

3. MACARTHUR FOUNDATION

In addition to its longstanding use of impact investments to further key philanthropic goals, the MacArthur Foundation has been working to better align its investments with its values and mission, including eliminating fossil fuels from its entire investment portfolio. Read More →

REPORT: AMERICAN JEWISH INSTITUTIONS CAN HELP FINANCE THE TRANSITION FROM FOSSIL FUELS TO CLEAN ENERGY

WITH A MORAL VOICE AND AN ESTIMATED $100 BILLION OF ASSETS INVESTED, THE AMERICAN JEWISH COMMUNITY IS WELL-POSITIONED TO TAKE MEANINGFUL CLIMATE ACTION and help finance the transition from fossil fuels to clean energy.

In December 2022, Dayenu published With All Our Might: How the Jewish Community Can Invest in a Just, Livable Future. This report set out to understand the impact major American Jewish institutions could have if they commit to screening out fossil fuels – coal, oil, and gas. Dayenu sought to establish a baseline for major Jewish communal investments in dirty energy. From there, Dayenu offers a pathway and resources for institutions to align their investments with their values, shifting financial support away from fossil fuels and toward clean energy and climate solutions.

report findings

Dayenu analyzed publicly available records of the four major denominational movements, 20 largest Jewish Federations and the national Federation body, and 20 largest endowed American Jewish foundations. This sample was chosen because of their large investment holdings, positional power, and the likelihood that their financial information would be publicly available.

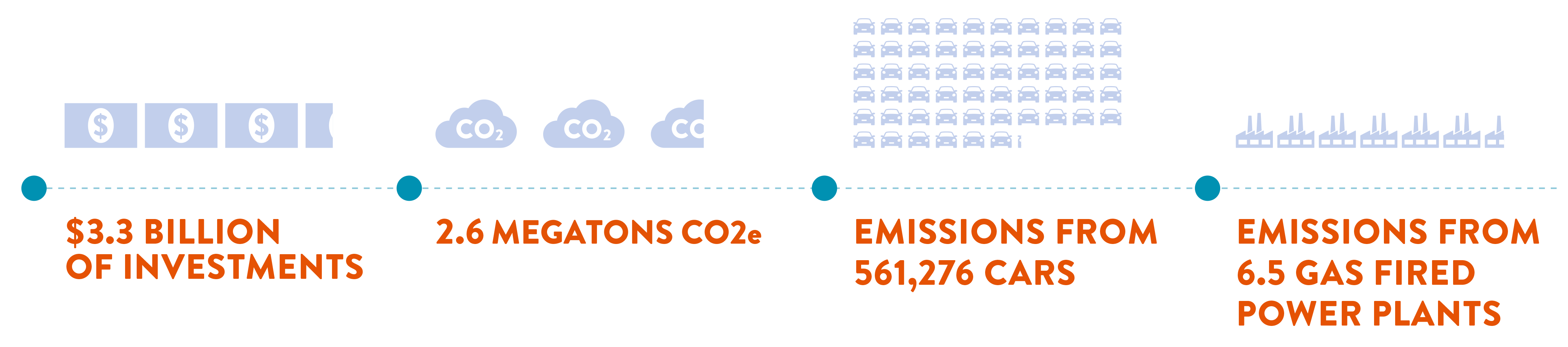

In total, Dayenu estimates that these major institutions — with $34.7 billion in investments — have a median of 5.54% invested in polluting fossil fuels, representing about $3.3 billion dollars in Jewish communal fossil fuel investments. The institutions included in the report on average held a slightly smaller percentage of their total investments in fossil fuels than the market average: a median of 5.54% for Jewish institutions versus 5.68% for the market as a whole.

To put this in context. Experts estimate that $1 billion in investments is the equivalent of emitting 868,300 tons of carbon into the atmosphere. So, $3.3 billion of investments is like emitting 2.6 megatons of carbon or the equivalent of emissions from 561,276 gas-powered passenger vehicles on the road or 6.5 natural-gas fired power plants operating for a year.

Denominational Movements

Major movement organizations hold at least $3.9 billion in total investments, and an estimated $218 million in fossil fuel investments, with a median exposure to fossil fuels of 5.66%.

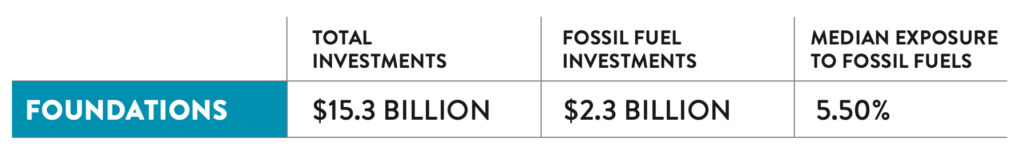

foundations

The large Jewish foundations examined in this report hold $15.3 billion in investments, and an estimated $2.3 billion in fossil fuel investments. There was a much wider range of total investments in fossil fuels among foundations, but a median exposure to fossil fuels of 5.50%.

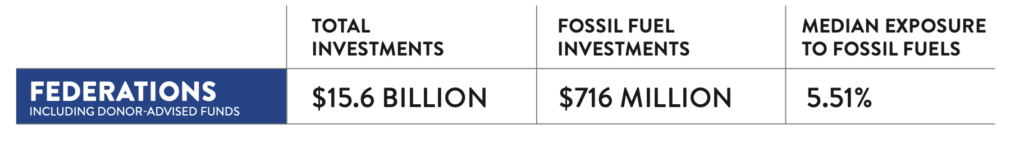

federations and community foundations

Major Federations and Jewish Community Foundations, and the national Federation body hold $15.6 billion in investments, and an estimated $716 million in fossil fuel investments, with a median exposure to fossil fuels of 5.51%.

AN OPPORTUNITY TO INVEST IN A JUST, LIVABLE FUTURE

Just among major American Jewish institutions, our research finds at least a $3.3 billion opportunity to confront the climate crisis and build a more just and livable future. And that’s just the start. There are many more Jewish institutions than are included in this report, each of which has the opportunity to join this collective effort. Furthermore, for institutions without endowments or investments, pressuring their banks to stop financing fossil fuels is an equally important strategy.

Beyond dollars and cents, by raising a moral voice and telling the story of our efforts, our calls for climate action can reverberate and reach financial districts across the continent. When we work together, in partnership with multifaith and secular allies, we will create a movement with the power to turn the tide of the climate crisis.

Watch the briefing

WITH ALL OUR MIGHT: HOW THE JEWISH COMMUNITY CAN INVEST IN A JUST, LIVABLE FUTURE

On December 15, 2022, Dayenu launched our With All Our Might report with a virtual briefing sharing our findings and laying out a path forward for Jewish institutions.

Frequently asked questions

Guided by our communal commitment to current and future generations, lifted by our moral voice, and delivered by our people power as customers and clients of the leading investors in dirty energy (major banks and asset managers), the American Jewish community is poised to play an important role in keeping fossil fuels in the ground. We join with multi-faith and secular partners who have been involved in this effort for decades, but we start with our own American Jewish community – a community that is alarmed by climate change, and needs to fully reckon with its role in backing the fossil fuel companies driving us down the path of destruction.

By joining together in a collective effort to move money away from fossil fuels and toward clean energy, Jewish institutions, alongside many others calling for change, can use finance to help turn the tide of the climate crisis.

Most of us are funding the coal, oil, and gas companies driving the climate crisis without even knowing it. That’s because the banks and asset managers handling our institutions’ money are channeling a portion of our investments toward polluting industries (typically at least 5% or as high as 10%). But we have the power to change this! First, by examining where our institutions’ accounts, stocks, bonds, mutual funds, retirement savings, and other investments are going. Then, by working with our colleagues, financial advisors, asset managers, and banks to make a plan for phasing out fossil fuel investments and identifying new opportunities to invest in the climate solutions – sustainable transportation, agriculture, industry, etc. – powering the clean energy economy.

Jewish values call on us to confront the climate crisis with bold action. Fossil fuels – coal, oil, and gas – are by far the leading contributors to climate change, and a relatively small number of corporations are responsible for the overwhelming majority of those greenhouse gas emissions. By moving our institutions’ money out of fossil fuels, we are ensuring that our investments are not profiting from and furthering the climate crisis.

Moreover, when we move our institutions’ money from fossil fuels to clean energy, not only are we aligning our investments with our values, we’re also funding the clean energy transition. Our banks and asset managers are financial institutions with trillions of dollars in investments. Asset managers are increasingly prioritizing “client choice.” So by demonstrating to our banks and asset managers that we expect them to stop funding fossil fuels, we’re helping to shift capital towards the climate solutions we need.

This is why, in spring of 2024, the Union for Reform Judaism became the first and largest denomination in the country – representing more than a third of American Jews – to move its investments out of fossil fuels and pass a resolution recommending its Reform synagogues and institutions do the same, and engage in shareholder advocacy with other polluting industries. And this is also why, a month prior, Oregon’s two Jewish Federations made history by becoming the first Federations to commit to screen fossil fuels out of their investments.

More than 1600 institutions with more than $40 trillion in assets have pledged to move their money out of dirty energy, the equivalent of the two largest global economies – the United States and China – combined. And the sector with the largest number of commitments: faith-based institutions. Now the American Jewish community has the opportunity to bring our resources to this collective effort.

When investors move their money en masse, fossil fuel corporations face reputational and brand risk that can have knock-on effects, including lower credit ratings and challenges with securing financing for projects and operations. By moving our own investments, we can help make owning stocks in fossil fuel companies less desirable for many investors, and make these risky industries less palatable for the banks and asset managers who continue to finance fossil fuel expansion.

We have the research to back it up:

- According to a recent Goldman Sachs report, concerns about fossil fuel companies raised by climate-focused investors are mostly responsible for cutting the economically viable life of oil projects more than 50% since 2014.

- In 2023, one of the world’s largest coal companies failed to secure financing to expand their operations because of efforts by the global climate movement. Oil refineries are similarly struggling to access funding to expand new projects as banks, pressured by this global effort, begin to move money away from fossil fuels and toward clean energy (though not nearly enough yet).

- Meanwhile, fossil fuel companies are running the risk of credit downgrades.

- According to recent research profiled in the Financial Times, these companies are hit extra hard by pledges to screen out fossil fuels that go viral, like the Republic of Ireland’s decision in 2018.

Ultimately, the goal is not to momentarily lower a fossil fuel company’s stock price, but to achieve meaningful social change to move our society off fossil fuels and toward clean energy. The more than $40 trillion dollars worth of investors moving money out of fossil fuels and toward a clean energy future have had a powerful effect on the zeitgeist. Faith-based and other ethical investors are shifting the moral story, clearly identifying fossil fuels as the problem and clean energy as the solution.

The world’s leading energy analysts are clear that there is enough fossil fuel to meet global energy demand. Instead, expanding further extraction will result in a “staggering” excess of fossil fuels in less than a decade as the world transitions to clean energy – and of course, will have devastating effects on our climate.

We support a responsible phaseout of fossil fuels aligned with what experts tell us is needed to meet the Paris Agreement goal of keeping global warming below 1.5°C/2.7 °F:

- No new development of oil and gas fields and no new coal-fired power stations or coal mines.

- Setting an aggressive timeline to sunset existing fossil fuels in order to halve global greenhouse emissions by 2030 and reach zero emissions well before 2050.

- Ensuring that developing countries receive the resources they need to bring their populations out of poverty without increasing emissions.

It’s important to remember that moving our investments from fossil fuels to clean energy is not the same as immediately ceasing fossil fuel production. We need to immediately stop fossil fuel expansion, and rapidly and justly transition to clean energy.

Alarmist claims are hallmarks of the fossil fuel industry PR strategy of denial and delay. Instead, moving our money away from fossil fuels aligns our investments with our Jewish values and helps hold financial institutions to their own climate pledges.

Dayenu defines a “fossil fuel investment” as an investment in any company on the global oil and gas exit list or global coal exit list These publicly available databases offer a widely recognized standard in fossil-fuel-free investing, capturing most upstream and midstream oil and gas companies as well as thermal coal companies.

Another common approach is screening out the Carbon Underground 200, which comprises the 100 largest oil/gas companies and 100 largest coal companies. This might be a direct investment in a company, or through a pooled fund.

Many institutions do not hold individual stocks in fossil fuels, but instead invest in funds, many of which hold a percentage of their investments in fossil fuels. If a fund (mutual fund or ETF) invests a percentage of its portfolio in fossil fuels, an investor in that fund owns a percentage of fossil fuel companies. You can learn more about how much you have invested in fossil fuels through your funds by using the handy tool at FossilFreeFunds.org. In those cases, you can follow the lead of the Reform movement, which recommends institutions pick funds “which include filters against investments in fossil fuel companies.”

One other note: when thinking about investing, we may first think “stocks.” But most Jewish institutions’ investment portfolios are made up of both stocks and bonds. Bonds often represent new money flowing directly to fossil fuel companies.

Banks are where we deposit our personal or institutional money for safekeeping. Most banks take the money we deposit and lend it out to multinational corporations, local businesses, and others. Every major U.S. bank includes coal, oil, and gas companies in their lending portfolio. Chase, Citi, and Bank of America have invested more in fossil fuels than any other global banks since the signing of the Paris Agreement.

Asset Managers are companies that many institutions use to invest in stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other assets. The biggest names in investment – BlackRock, Vanguard, and Fidelity – are American asset managers, managing trillions of dollars in hundreds of funds, most of which include fossil fuel stocks and bonds. For institutions or high-net-worth individuals, asset managers can also manage customized portfolios. Collectively, asset managers control nearly a quarter of the publicly-traded coal, oil, and gas market.

It’s your choice. Asset managers are gaining fluency with socially responsible investing (SRI), including investing with climate in mind. In fact, some estimate that a third of all investment dollars are now invested with an eye toward social responsibility. Just as your financial advisor or asset manager should take the time to understand your institution’s financial needs, they can also help ensure your institution’s values and investment decisions are aligned. A growing number of asset managers do exactly that, and have even built teams to help develop climate-safe investment funds that screen out fossil fuels, and funds that expressly invest in clean energy and climate solutions.

Any financial advisor or asset manager should be able to deliver fossil-free investment options that serve your institution’s financial needs and risk profile. And if they don’t yet, you can help by asking for better investment options. We have sample letters and talking points you can use when approaching and engaging them.

By making the ask directly to your investment advisor or asset manager, you’re ensuring your actions have an even greater impact. When we demonstrate demand for more clean energy investment opportunities, we can help shift capital away from fossil fuels and towards clean energy and climate solutions that are needed to fund a just and livable future for generations to come.

If you are not getting the support you need, you can always take your business elsewhere. In fact, our education and advocacy efforts can take on greater urgency if our asset managers know we would consider switching financial institutions to ensure our needs are met.

When it comes to banks, you have less of a say in where your money goes. Most of the biggest banks continue to loan out the money your institution deposits to fund or underwrite fossil fuel projects or provide general operating support to coal, oil, and gas companies. Many of these banks do this despite pledging meaningful climate action.

If your institution is interested in advocating with your bank, let us know at info@dayenu.org so we can offer support.

Major Banks: Dayenu recommends reviewing the “Banking on Climate Chaos” report. For a more technical read, see “Leaders or Laggards? Analyzing US Banks’ Net Zero Commitments” from the Sierra Club. For smaller banks, you may need to ask your bank rep directly about their lending policies on fossil fuels.

Asset Managers: Dayenu recommends reviewing the “Investing in Climate Chaos” report and the major fund managers’ portfolios at Fossil Free Funds. You can also take a look at each asset manager’s record of climate voting on shareholder proposals, which are an indicator of how serious they are about achieving ambitious climate goals.

Many financial institutions publish their own reports highlighting what funds they have available and whether they offer fossil-free funds. But review these documents with a critical eye to avoid falling prey to greenwashing. Bloomberg compiled a checklist to help.

Investing in climate solutions – renewable energy, electric vehicles, sustainable transit, etc. – is a great start. But experts estimate that for every $1 we invest in fossil fuels, we need $4 dollars in clean energy investments to make up for it. To have the impact we need in the time we have left to turn the tide of the climate crisis, we must also turn off the flow of money to fossil fuel companies.

To put it simply: Impact investing in climate without also screening out fossil fuel companies is like undergoing lung cancer treatment while continuing to smoke. For the health and future of our planet, our institutions need to leave fossil fuels behind once and for all.

Shareholder activism is a strategy where investors use their stake in a company in order to advocate with management to change the company’s business practices.

Decades of shareholder activism demonstrate that it cannot change a company’s core business model. And the core business model of coal, oil, and gas companies is the extraction and distribution of polluting fossil fuels. For example, climate-concerned shareholder activists managed to replace a quarter of Exxon’s board – yet two years later, the company doubled down on its commitment to fossil fuels for multiple decades to come and sued shareholders who proposed that it take more robust climate action. Shareholder activism with fossil fuel corporations has proven to be a dead end.

However, shareholder advocacy may be able to help hold publicly-traded banks and asset managers to their commitments. Dayenu’s allies at the Interfaith Center for Corporate Responsibility, Sierra Club, Majority Action, and elsewhere deploy this strategy, as does the Reform movement. But this engagement is only impactful if the executives at these financial institutions feel pressured to change. That’s where we come in. Jewish institutions can help provide much-needed pressure as financial institutions’ customers and clients.

In short, no. ESG funds rate companies on their performance on Environmental, Social, and Governance issues, and buy shares in the best-scoring companies (or sometimes the “most-improved companies”). You might think an ESG fund would exclude the leading contributors to global climate change, but some ESG funds include fossil fuel companies like BP and Exxon because of their scores on other issues.

While it is possible to do both – some fossil fuel-free funds do also consider ESG factors in evaluating their other holdings – whether or not to invest in ESG is a separate question. To take climate action at the level that science and justice demand, we must screen out the companies whose core business model is the extraction and distribution of the fossil fuels driving the climate crisis.

ESG investing as a strategy has lately come under increased scrutiny. There may be contexts in which ESG investing makes sense for an institution or an individual. But the most important action institutional investors can take right now to combat the climate crisis is to stop investing in fossil fuels, whether choosing to engage with ESG or not.

There’s no denying that fossil fuels are volatile and risky investments both for our portfolios and for the world.

For a time, oil and gas were raking in record profits by profiteering off the energy crisis Russia triggered when it invaded Ukraine, and doing so on the backs of working families. These ill-gotten gains, which go against our Jewish values, were also fleeting.

In the long-term, continued investment in fossil fuels is a losing bet as renewable energy continues to get more affordable. In fact, the leading energy experts in the world expect fossil fuel demand to drastically fall in the next decade. The stock buy-backs and record returns to shareholders were viewed by many analysts as the last gasps of a dying industry.

Just look at the numbers: over the past decade, by rough estimate, the stock market has returned 11% annually. The fossil fuel sector has gone up by 1% annually. Institutions who moved their money out of fossil fuels a decade ago are doing better than if they had kept their money in fossil fuels.

The number of fossil fuel-free investment funds has grown in recent years, and some major banks and asset managers now offer a range of options for investors. Any financial advisor or asset manager should be able to deliver fossil-free investment options that serve your institution’s financial needs and risk profile. And if they don’t yet, you can help by asking for better investment options. We have sample letters and talking points you can use when approaching and engaging them.

By making the ask directly to your investment advisor or asset manager, you’re ensuring your actions have an even greater impact. When we demonstrate demand for more clean energy investment opportunities, we can help shift capital away from fossil fuels and towards clean energy and climate solutions that are needed to fund a just and livable future for generations to come.

Change is never easy, and you might encounter some initial resistance from financial professionals who are less familiar with fossil-free investing. But screening out fossil fuels is becoming more and more understood as a critical way to address the climate crisis. Mainstream institutions, from Brandeis University and Harvard to many of the New York City Pension Funds have made this move. Be persistent and use the discussion guide to bolster your case.

Fiduciary duty refers to a person or group’s responsibility to act in their members’ best interest when making investment or other financial decisions. Investment managers have a legal duty to their clients; pension fund directors have a responsibility to their pension’s participants; board members have a responsibility to their non-profit organizations; and so on.

Investment or asset managers may claim that their fiduciary duty prevents them from screening out fossil fuels, but the math doesn’t hold up. Transitioning away from fossil fuels isn’t only good for the planet – it also makes financial sense, will save investors and consumers money, and will create millions of jobs. In recent years, fossil fuels have underperformed the market. As the price of renewable energy continues to drop, investors can expect to see diminishing returns or even significant losses. Further, we know that fossil fuel companies increase overall portfolio risk through the climate damage they cause, such as more frequent and intense extreme weather events. Researchers found that the world economy could lose 10% of its value by 2050 if the global community fails to address the climate crisis. That is why more than 1600 institutions have seen it as aligned with their fiduciary duty to move their investments out of fossil fuels – including public pensions like New York City, health organizations like the National Academy of Medicine, and religious institutions like the Reform movement.

To avoid risk and align our investments with our values, we encourage Jewish institutions to consider screening out fossil fuel and investing in clean energy and climate solutions as adhering to their fiduciary duty.

Despite fossil fuel companies’ messaging, oil and gas company spending on renewables is less than 5% of total capital expenditure and has been that low for years. The numbers indicate that when it was profitable and politically expedient to do so, fossil fuel companies named future aspirations to reduce their greenhouse gas emissions and promised to invest more in renewables. As soon as energy prices rose, these climate commitments evaporated. Fossil fuel companies pulled back on renewables investments, and instead increased oil and gas production, making clear they had zero intention of changing their core business model of extraction and pollution.

If you need more data: BP has abandoned plans to reduce oil. Shell has scaled back its offshore wind business and instead plans to produce more oil and gas. Exxon has predicted oil demand will remain the same through 2050, sued shareholders who proposed that it take more robust climate action, and recently issued fossil fuel bonds maturing in 2074 – more than 20 years after the world needs to have reached net-zero. Even today, fossil fuel companies contribute a vanishingly small piece (less than 1.5%) of global clean energy investment. And nearly all fossil fuel corporations worldwide are expanding their dirty energy operations, instead of pivoting to renewables.

You are in the driver’s seat. You’ll work with your investment committee, CFO, investment advisor, and/or bank representative to make a thorough accounting of your investments. You’ll work through them one-by-one to identify where exactly your money is invested, develop a phased plan for moving any money invested in fossil fuels to funds or products that screen out fossil fuels, and consider investing in clean energy solutions.

The good news: There are a lot of resources out there. Visit dayenu.org/climateinvest for additional information. There are also plenty of organizations – some of which are profiled in Dayenu’s All Our Might report – that have already embarked on or completed this journey and can share what they’ve learned along the way. Your financial advisor or asset manager can also help. And if you’re looking for more assistance, reach-out to info@dayenu.org for recommended financial experts who have experience in fossil-free investing.

ABOUT ALL OUR MIGHT

In the V’ahavta prayer that we recite as part of the Sh’ma, we are exhorted to love God “with all our heart, with all our soul, and with all our might.” Some of the ancient rabbis interpret the phrase “bechol m’odecha,” “with all our might” as “all our possessions” or “all our money.” Our tradition recognizes that our values must extend to our money, and indeed, finance is a key lever for climate action.

To end our reliance on dirty energy and move toward a just and livable future, we need to bring all the people and power of the American Jewish community to bear — we need to bring all our might. If our institutions join others in withholding financial backing — our investments — from dirty energy companies and invest in a clean energy future, we can help turn the tide of the climate crisis.

Dayenu’s All Our Might campaign is aimed ending the era of fossil fuels and building the clean energy economy. By denying oil, gas, and coal companies the financial backing and social license to operate, we can hasten the transition to a clean energy economy, and safeguard our future l’dor vador, from generation to generation.a